New Year Checklist

January is a great time to consider your financial wellness outlook, here are five things to review for the new year.

1st – Get Your Tax Info in Order

- By mid-January, year-end tax statements will start arriving. Prepare now by collecting your W-2’s, 1099’s, and all other tax statements. Many of these tax documents are delivered online so ensure to check your email for these as well.

- Clients of Harman Wealth can find their forms by logging into their eQuipt account and looking under the document section. Jan. 31st is a good time to start checking for these.

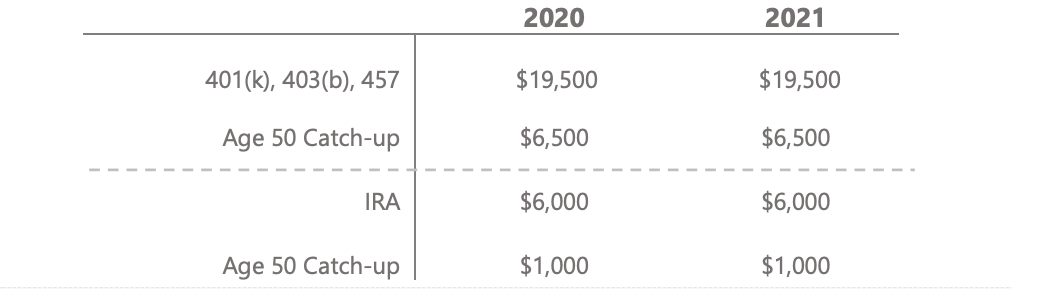

2nd – Update Contributions to Your Retirement Accounts

- Contribution limits on employer sponsored qualified plans remain the same for 2021. Be sure to update your contributions if you want to max them out.

3rd – Review Your Beneficiary Designations

- Did you have a major life change last year? (birth of a child or grandchild, marriage, divorce, or death). If so, update your beneficiaries on insurance policies, IRA’s, & qualified plans to reflect your current wishes.

4th – Re-anchor your portfolio to your rightful risk profile

- Last year saw heightened risk as the economy fell into recession. For 2021, ensure your risk orientation is aligned with your overall objectives.

5th – Sign Up For Identity Theft Insurance

- The world in 2020 moved rapidly towards digital commerce. Now more than ever, ID theft insurance should be considered as necessary as homeowners and auto insurance.

- Where can you find a provider? Look to specialty groups such as Life Lock or Identity Guard. Many property and casualty insurance providers offer coverage.