It seems as if the global COVID-19 pandemic has touched every facet of daily life in 2020. The pending U.S. election will be no different.

With summer now fading, all eyes are turning to the U.S. election in November. Considering the astonishing developments since the global pandemic intensified in March, investor psychology may be more anxious than any other presidential election in recent memory. Even though the final outcome of the election is too unpredictable, investors may want to prepare for four interesting ways in which COVID-19 will influence this election cycle.

1. A Referendum on the COVID-19 Response?

Usually, a first term president is judged on the body of work over their full term. At the end of February, President Trump offered quite a few actions for Americans to review. Corporate tax cuts, personal income tax cuts, a revised trade agreement with Canada and Mexico, and an economy at full employment – just to name a few. Then, of course, the COVID-19 recession ensued.

Historically, recessions have been catastrophic for incumbents on election day (e.g. Bush, Carter). However, the current scenario is so distinctly different that the administration will likely get assessed on crisis management since March. Rather than blaming the president for recessionary conditions, swing voters likely cast their votes based on the perceived recovery.

2. Worried about Pre-election volatility?

A quick look at market history shows the months in front of election day are usually pretty calm as market investors tend to pause in the face of uncertainty (Ned Davis Research).

Nevertheless, our present situation has some interesting forces at work. For one, a tried and true recovery is at hand. Data across jobs, manufacturing, retail sales, and housing all offer encouraging signs a recovery is building momentum. Even more, COVID vaccine leaders Pfizer and Moderna set expectations for potential news on the progress of vaccine development by the end of October. Conversely, though, Congress has failed to pass a much anticipated “second stimulus.” All such events could weigh-in on market sentiment independent of the presidential race.

“All in all, investors should not be surprised if the election outcome is still unclear on Wednesday, November 4th. Across six swing states, there could be as many as 71 electoral votes decided after election day.”

3. Growing Probability of a Delayed Election Outcome

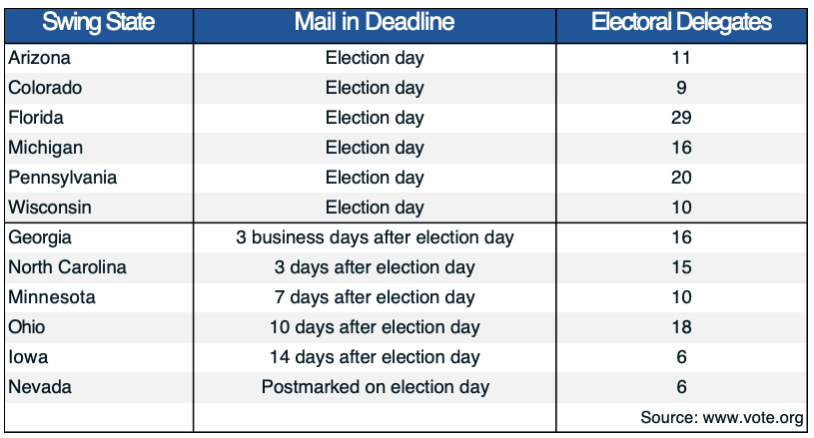

With an ongoing priority of protecting vulnerable populations from COVID-19, absentee mail-in balloting will hit all-time record highs this coming election. A presumed difficulty in receiving and counting those ballots could make matters contentious, especially in close races where the ballots can come in days after election day.

All in all, investors should not be surprised if the election outcome is still unclear on Wednesday, November 4th. Across six swing states, there could be as many as 71 electoral votes decided after election day.

4. What happens if my candidate doesn’t win?

It’s a common fear – the thought of your candidate not winning can be pretty unsettling for most Americans. But, regardless of who wins, don’t expect any major deviations right away. Managing COVID policy and leading the economy through a recovery will still be the two highest policy priorities for some time ahead.

The economic progress of the last few months has been highly encouraging, and its path will likely continue to shape the next year. While the candidates could vary drastically in the style and substance of their policy proposals, supporting the economy will continue to lead until unemployment comes back down.